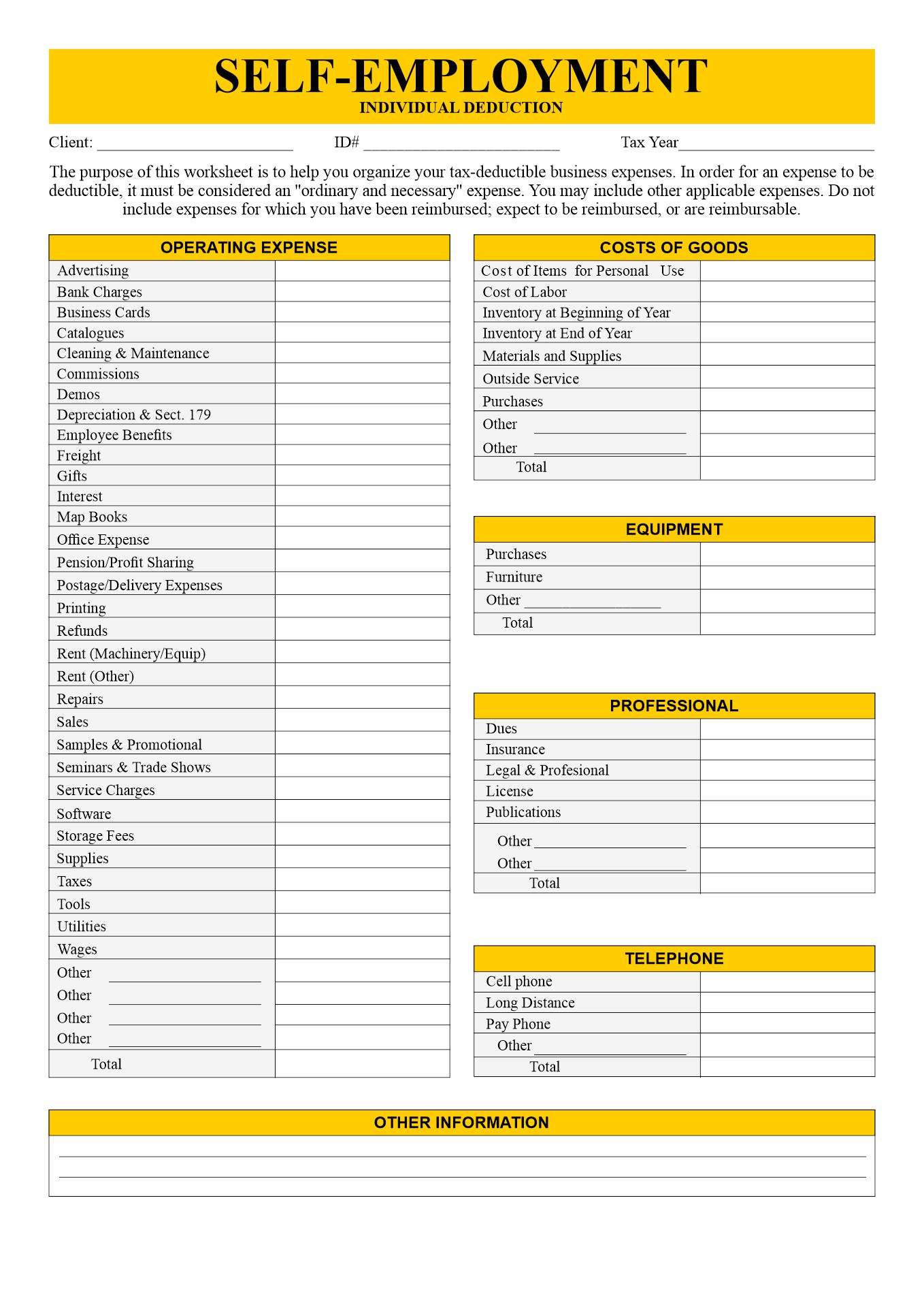

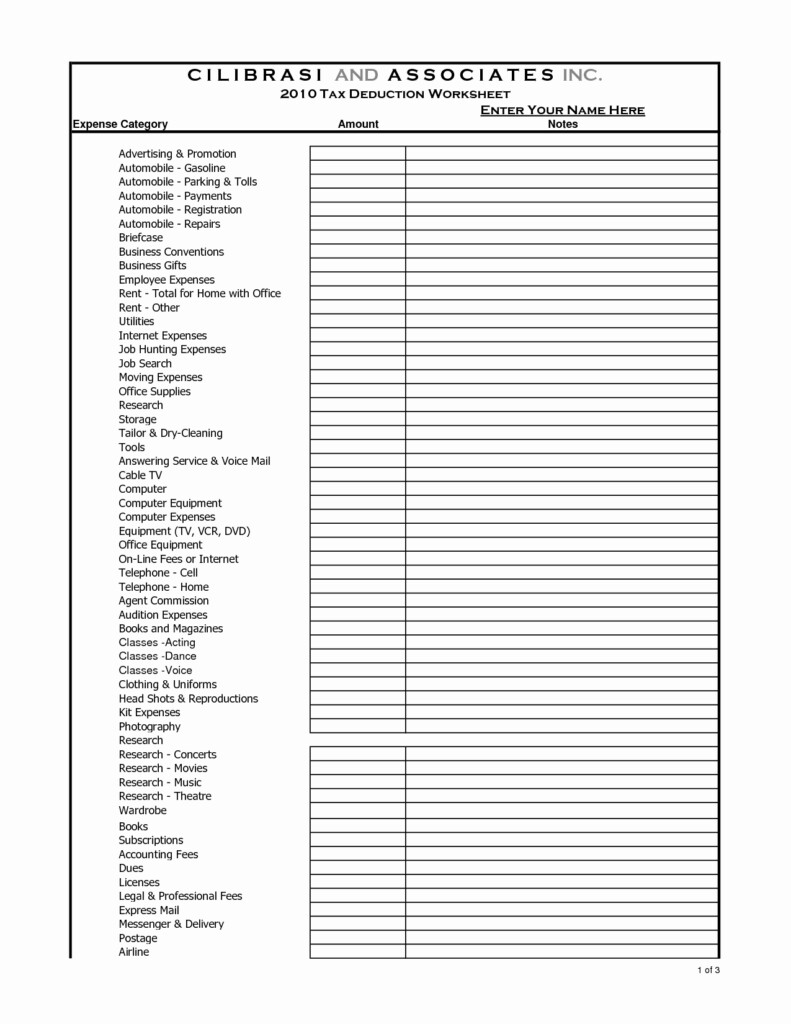

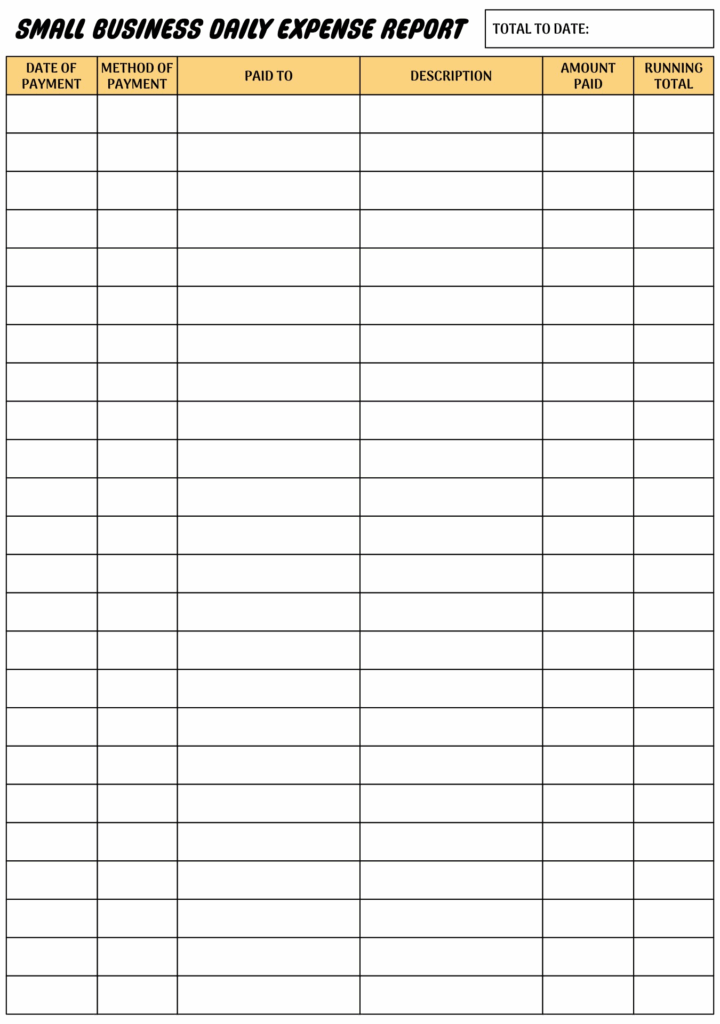

Running a small business comes with a variety of expenses that can quickly add up. Keeping track of these expenses is essential for managing your finances and maximizing your tax deductions. One way to stay organized is by using a printable self-employed tax deductions worksheet. This worksheet can help you categorize your expenses and ensure you are claiming all eligible deductions come tax time.

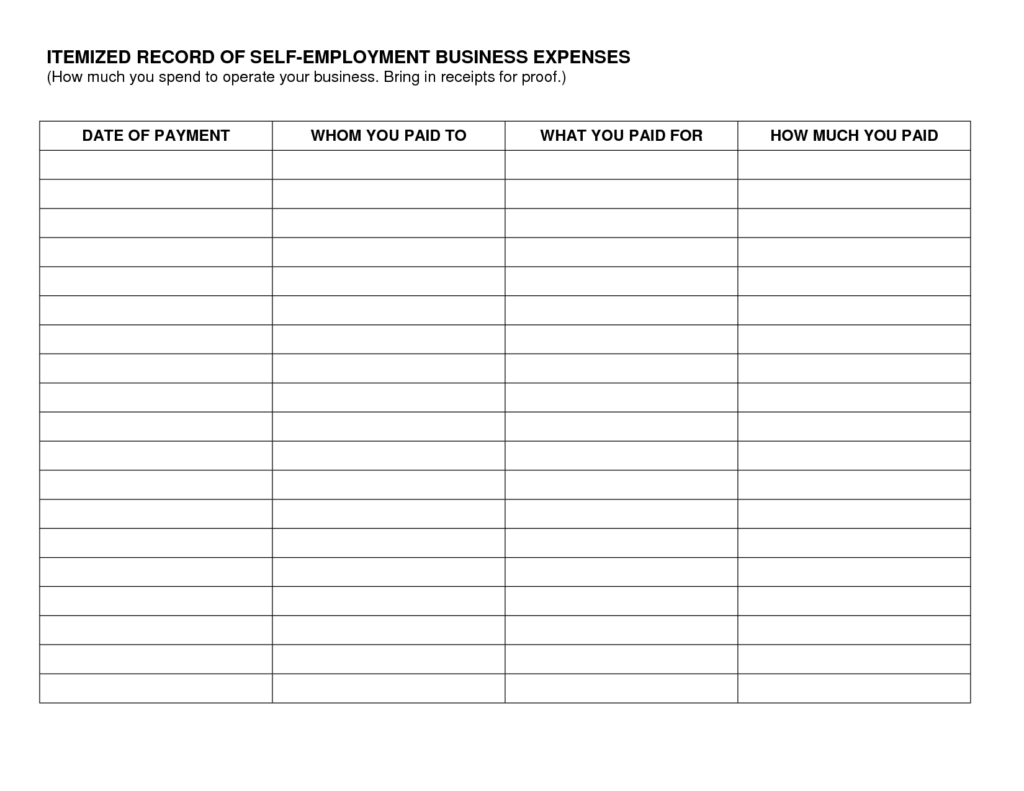

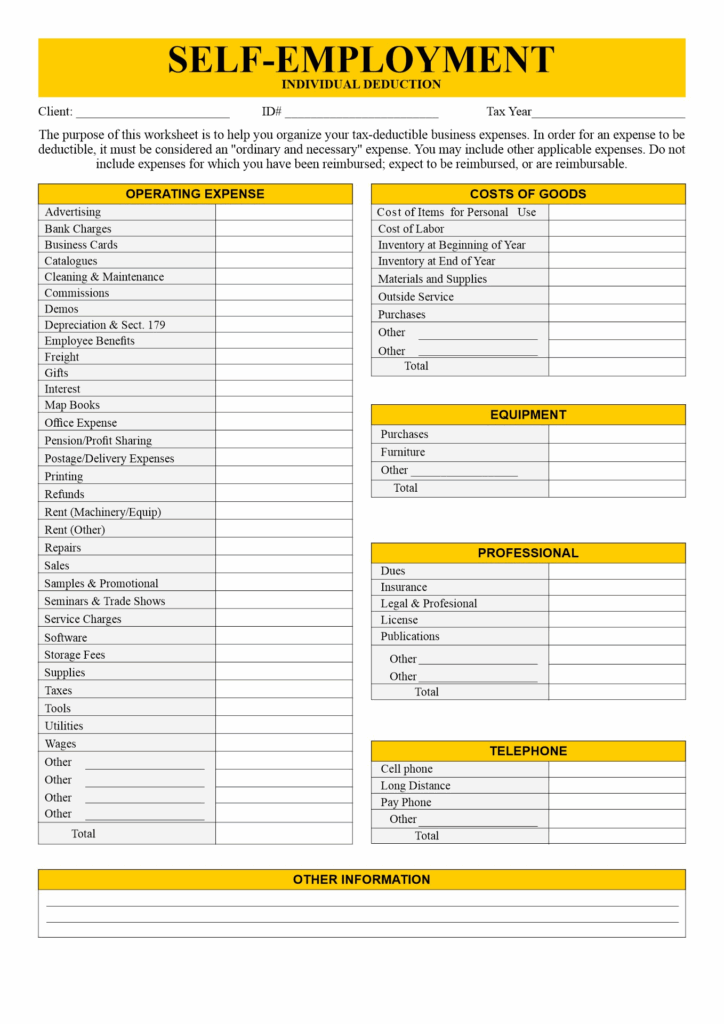

Some common small business expenses that may be eligible for tax deductions include office supplies, marketing and advertising costs, travel expenses, and professional fees. It’s important to keep accurate records of these expenses throughout the year to make filing your taxes easier. By using a printable worksheet specifically designed for self-employed individuals, you can easily track and categorize your expenses for maximum tax savings.

Benefits of Using a Printable Worksheet

Using a printable self-employed tax deductions worksheet offers several benefits for small business owners. First and foremost, it provides a structured way to organize your expenses, making it easier to identify potential deductions. This can help you save time and money when it comes to preparing your tax return.

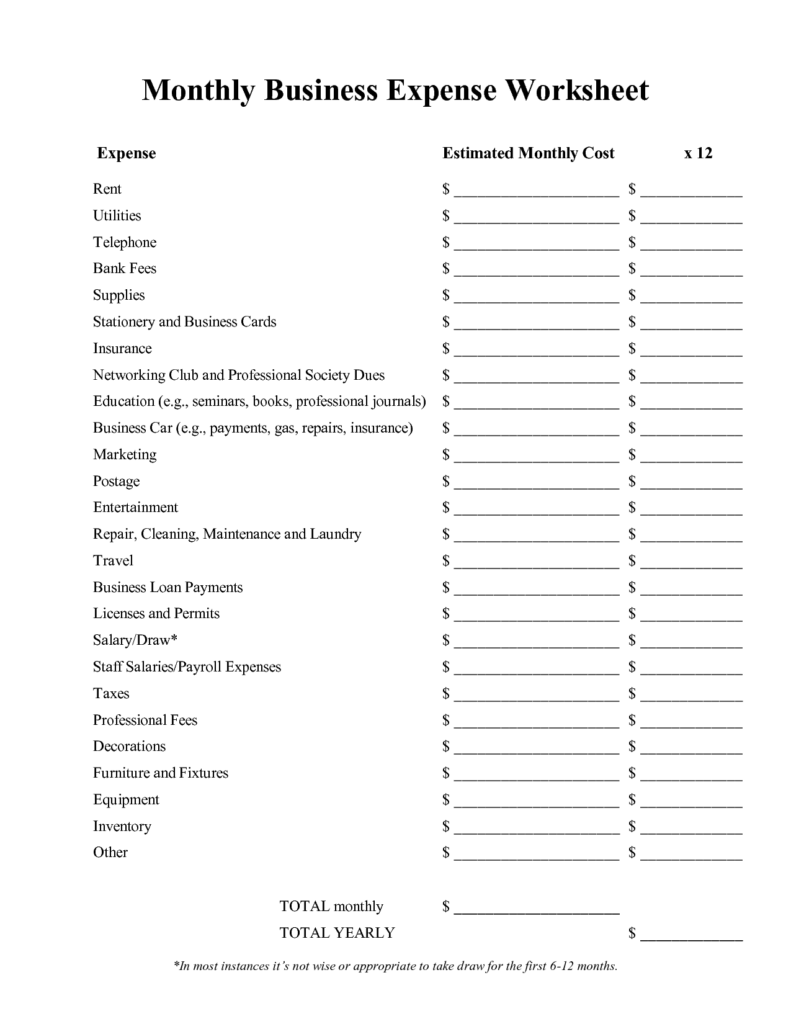

Additionally, a printable worksheet can serve as a valuable tool for budgeting and financial planning. By tracking your expenses regularly, you can gain insights into your spending habits and identify areas where you may be able to cut costs. This can help you make more informed decisions about your business finances and ultimately improve your bottom line.

How to Use a Self-Employed Tax Deductions Worksheet

When using a printable self-employed tax deductions worksheet, start by categorizing your expenses into different categories such as office supplies, utilities, travel, and professional fees. Be sure to keep detailed records of each expense, including receipts and invoices, to support your deduction claims.

As you track your expenses throughout the year, periodically review your worksheet to ensure you are capturing all eligible deductions. This can help you avoid missing out on potential tax savings and ensure you are maximizing your deductions come tax time.

Overall, utilizing a printable self-employed tax deductions worksheet can help streamline your tax preparation process, save you time and money, and ensure you are taking advantage of all available deductions as a small business owner.