A snowball debt worksheet is a helpful tool designed to assist individuals in managing and paying off their debts. This worksheet typically includes sections for listing all of your debts, including the balance owed, interest rate, minimum monthly payment, and any other relevant information. By organizing your debts in one place, you can get a clear picture of your financial situation and create a plan to pay off your debts efficiently.

Using a snowball debt worksheet can be especially beneficial for those looking to follow the snowball method of debt repayment. This method involves paying off your debts from smallest to largest, regardless of interest rate, to build momentum and motivation as you see your debts disappear one by one.

How to Use a Snowball Debt Worksheet Printable

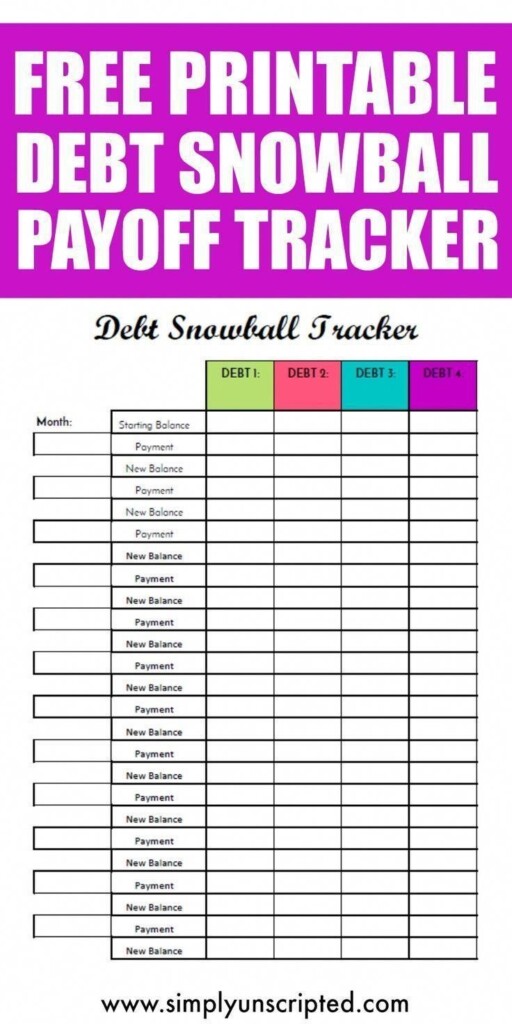

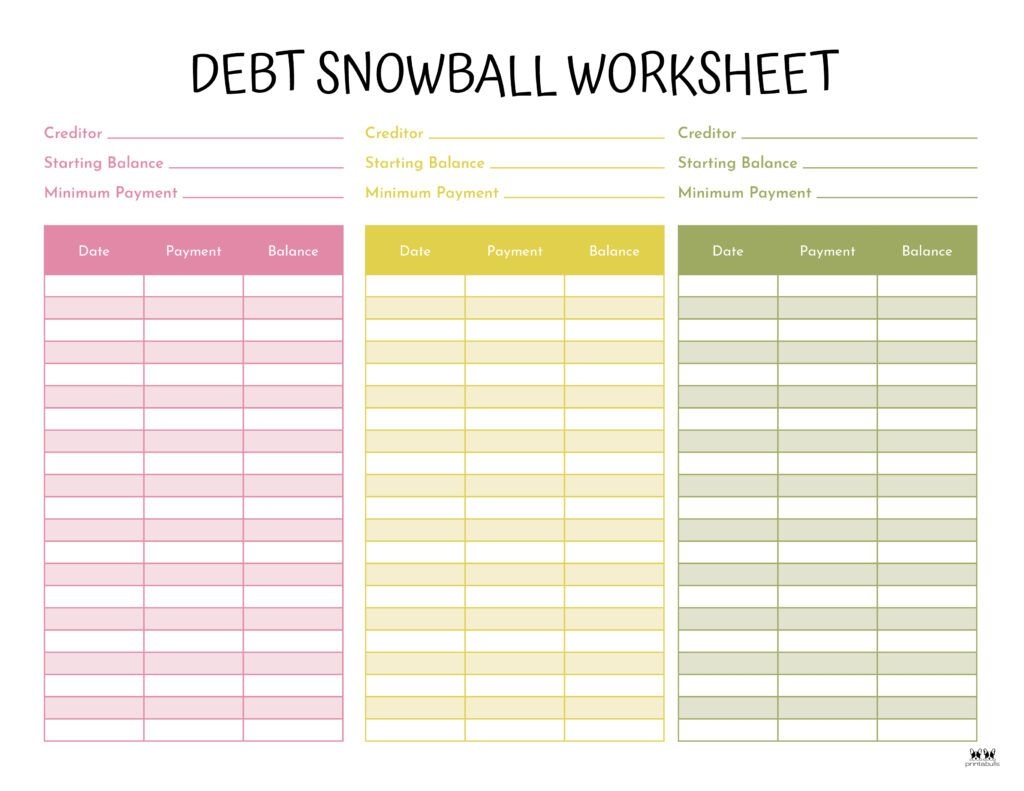

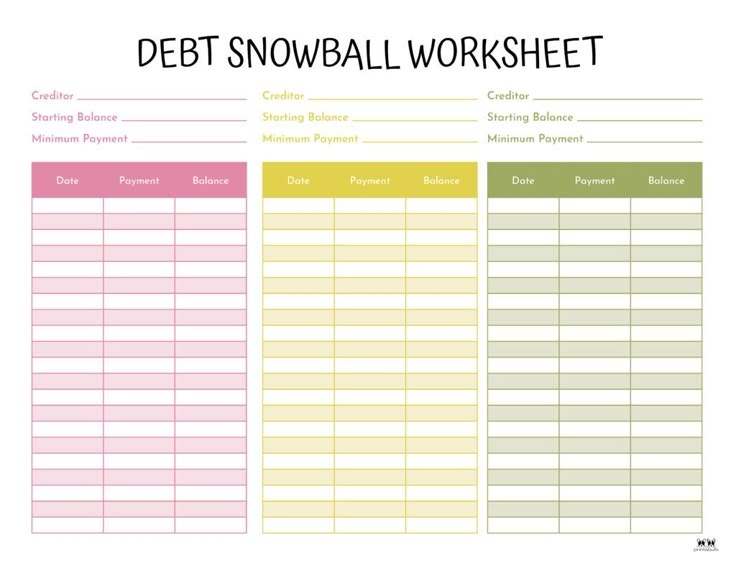

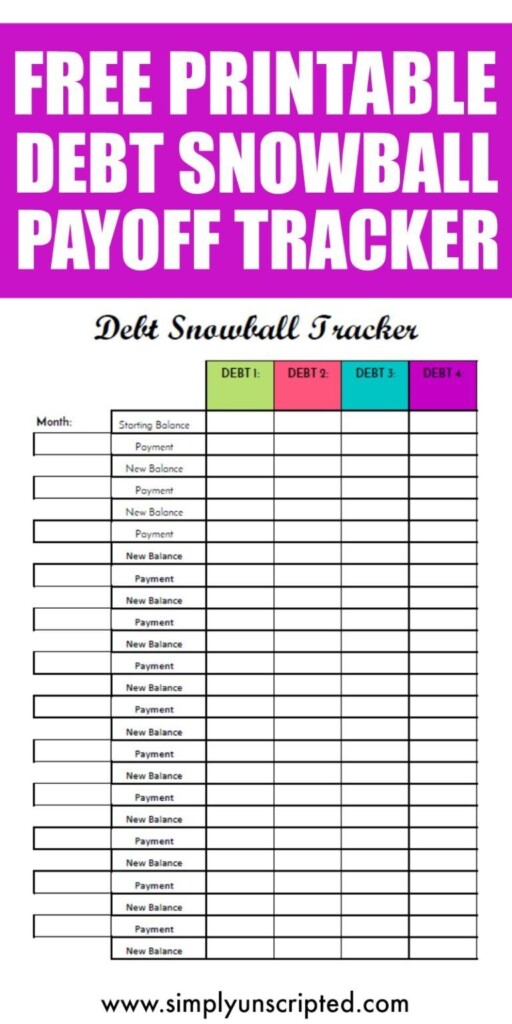

When using a snowball debt worksheet printable, start by gathering all of the necessary information for each of your debts. This may include credit card balances, personal loans, student loans, and any other outstanding debts you may have. Once you have all the information, input it into the worksheet and calculate the total amount of debt you owe.

Next, prioritize your debts based on the amount owed, starting with the smallest balance. Make minimum payments on all your debts while allocating extra funds towards paying off the smallest debt first. As you pay off each debt, roll over the amount you were paying towards the next smallest debt, creating a snowball effect that accelerates your debt repayment process.

Conclusion

A snowball debt worksheet printable is a valuable tool for anyone looking to take control of their finances and pay off their debts. By organizing your debts and following a structured repayment plan, you can make significant progress towards becoming debt-free. Take advantage of this resource to create a clear roadmap towards financial freedom and start your journey towards a debt-free future today.