As a truck driver who operates as an owner-operator, it’s important to stay organized and keep track of your expenses to maximize your tax deductions. One helpful tool for managing your expenses is a printable Truck Driver Expense Owner Operator Tax Deductions Worksheet. This worksheet allows you to record all of your deductible expenses in one place, making tax time less stressful and ensuring you’re claiming all the deductions you’re entitled to.

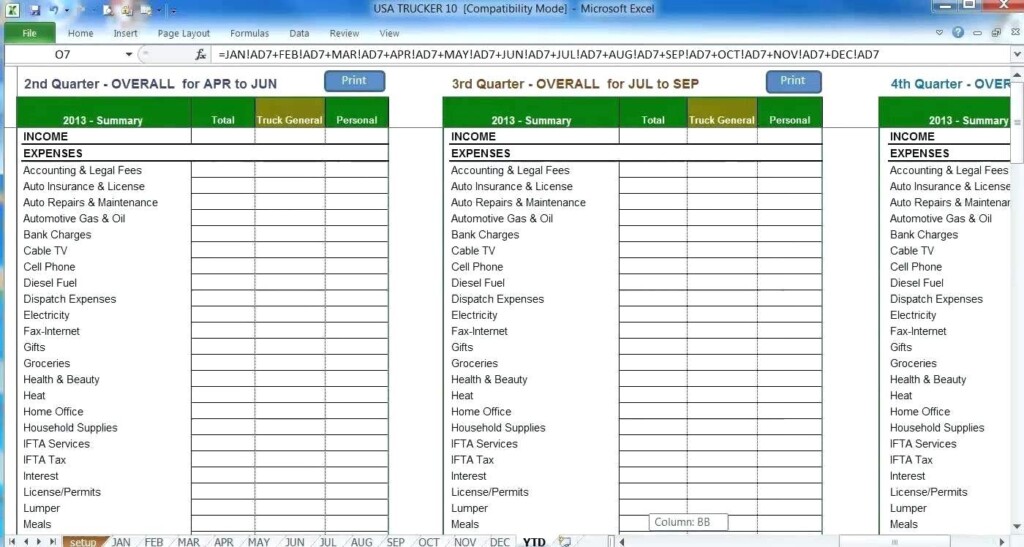

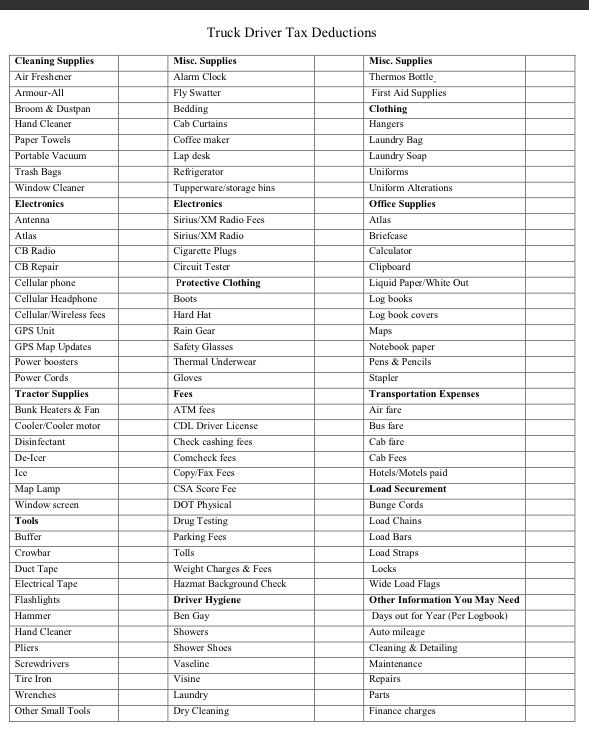

Some common tax deductions for owner-operator truck drivers include fuel costs, maintenance and repairs, insurance premiums, meals and lodging while on the road, and any fees or dues related to your business. By using a printable worksheet specifically designed for truck drivers, you can easily categorize and track these expenses throughout the year, making it easier to calculate your total deductions come tax time.

How to Use a Printable Truck Driver Expense Worksheet

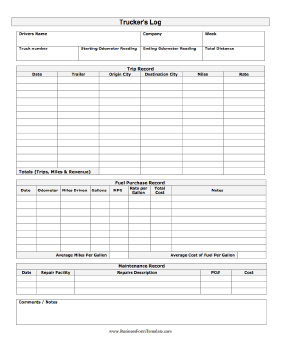

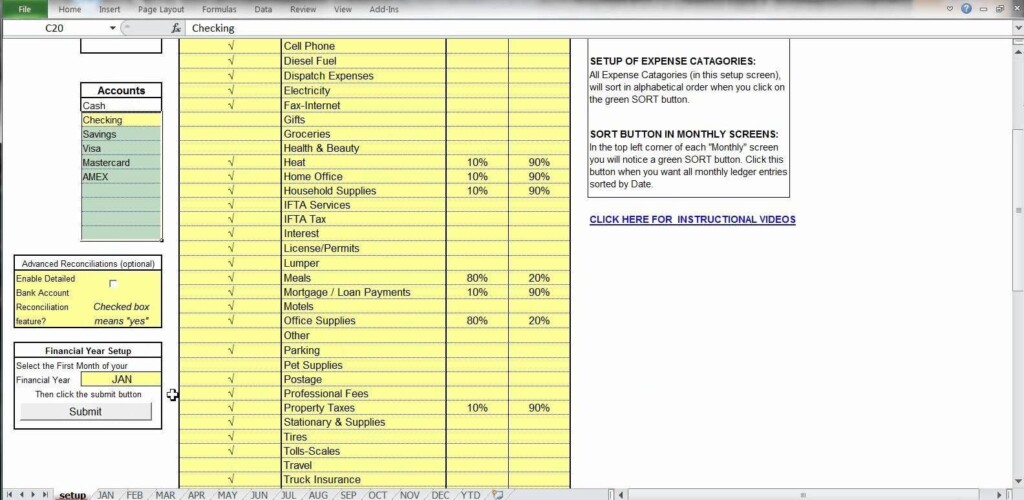

When using a printable Truck Driver Expense Owner Operator Tax Deductions Worksheet, it’s important to be thorough and accurate in your record-keeping. Start by entering your business information at the top of the worksheet, including your name, address, and employer identification number (EIN) if applicable. Then, list out all of your deductible expenses in the appropriate categories, such as fuel, maintenance, insurance, and meals.

Make sure to keep all of your receipts and supporting documentation for each expense, as the IRS may request proof of your deductions in the event of an audit. By maintaining organized records and using a printable worksheet to track your expenses, you can confidently claim all of the tax deductions you’re entitled to as a truck driver and owner-operator.

Benefits of Using a Printable Worksheet for Tax Deductions

Using a printable Truck Driver Expense Owner Operator Tax Deductions Worksheet offers several benefits for truck drivers. First and foremost, it helps you stay organized and ensures you don’t miss any deductible expenses when filing your taxes. Additionally, having all of your expenses in one place makes it easier to calculate your total deductions and provides a clear snapshot of your business finances.

Furthermore, using a worksheet designed specifically for truck drivers ensures you’re capturing all of the unique expenses associated with your industry, such as fuel and maintenance costs. By taking advantage of this tool, you can streamline the tax preparation process and potentially save money by maximizing your deductions. So, download a printable Truck Driver Expense Worksheet today and start taking control of your tax deductions as an owner-operator truck driver.