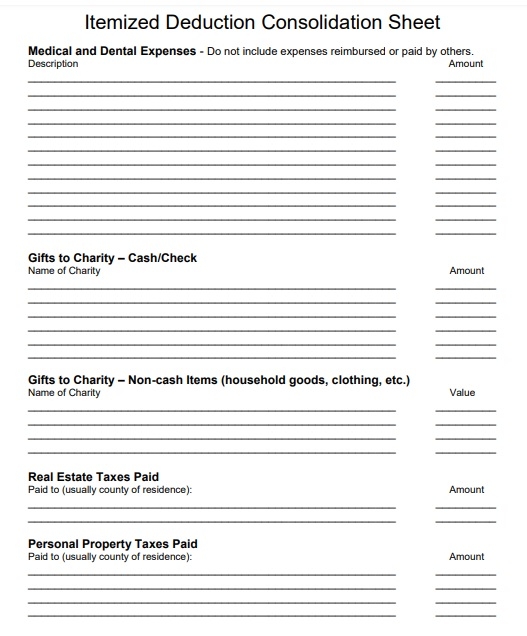

An itemized deductions worksheet is a tool that helps taxpayers keep track of their deductible expenses throughout the year. This worksheet is especially useful for individuals who choose to itemize deductions on their tax return, rather than taking the standard deduction. By carefully documenting each deductible expense on the worksheet, taxpayers can ensure that they are claiming all eligible deductions and maximizing their tax savings.

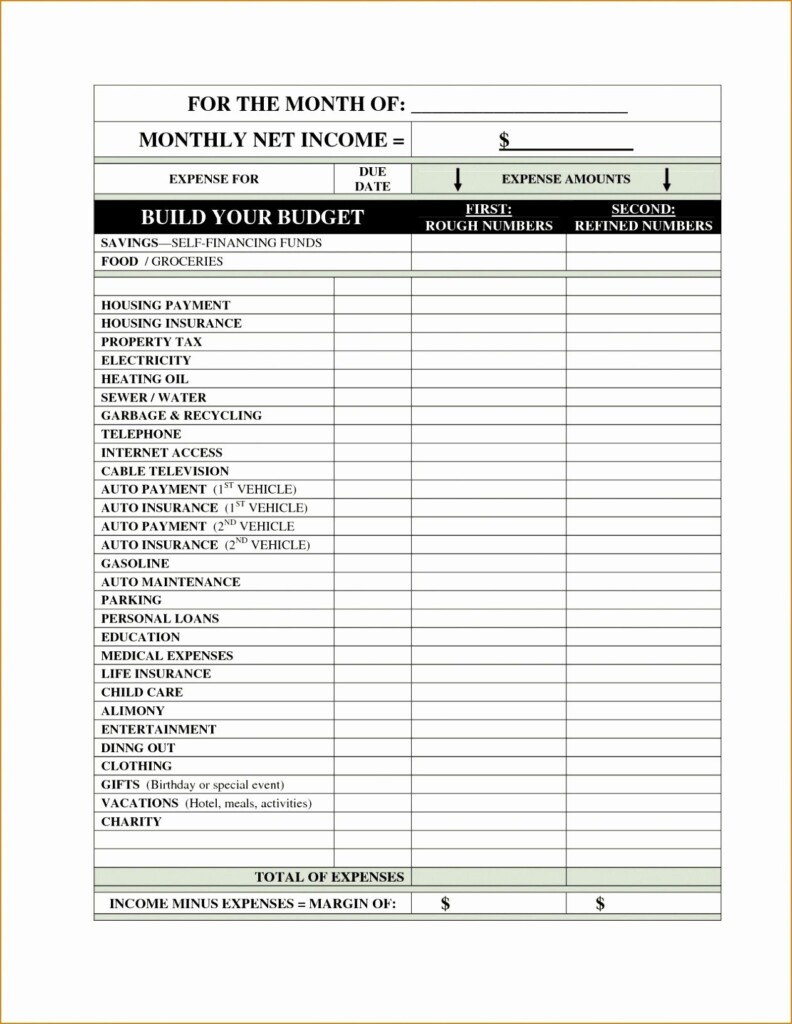

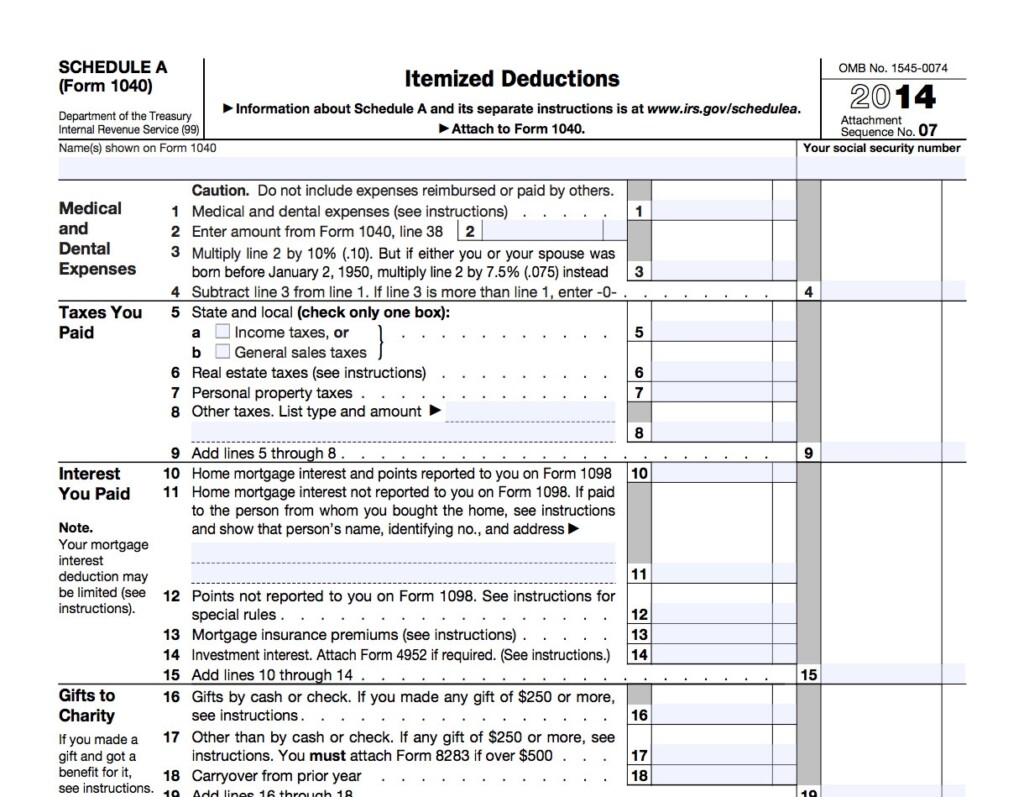

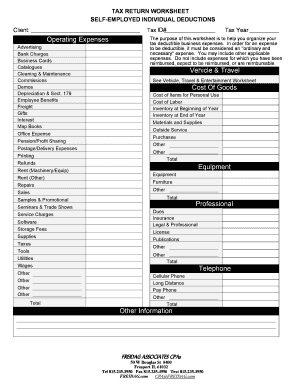

Common deductible expenses that can be included on an itemized deductions worksheet include medical expenses, state and local taxes, mortgage interest, charitable contributions, and unreimbursed business expenses. By using a printable itemized deductions worksheet, taxpayers can easily organize and categorize these expenses, making it easier to calculate their total deductions at tax time.

Benefits of Using a Printable Itemized Deductions Worksheet

One of the main benefits of using a printable itemized deductions worksheet is that it can help taxpayers avoid missing out on valuable deductions. By keeping a detailed record of their deductible expenses throughout the year, taxpayers can ensure that they are claiming all eligible deductions when it comes time to file their tax return. This can result in significant tax savings and help taxpayers maximize their refund or minimize their tax liability.

Additionally, using a printable itemized deductions worksheet can help taxpayers stay organized and reduce the stress of tax season. By having all of their deductible expenses neatly documented in one place, taxpayers can easily provide this information to their tax preparer or input it into tax preparation software. This can streamline the tax filing process and help taxpayers avoid errors or omissions on their tax return.

How to Use a Printable Itemized Deductions Worksheet

Using a printable itemized deductions worksheet is simple and straightforward. Taxpayers can start by downloading a printable worksheet template from a reputable source, such as the IRS website or a trusted tax preparation website. Once the worksheet is downloaded, taxpayers can begin entering their deductible expenses into the appropriate categories, such as medical expenses, charitable contributions, and mortgage interest.

As taxpayers incur deductible expenses throughout the year, they should make sure to keep all relevant receipts and documentation, which can be attached to the worksheet for reference. At the end of the year, taxpayers can total up their deductible expenses and transfer this information to their tax return. By using a printable itemized deductions worksheet, taxpayers can ensure that they are claiming all eligible deductions and maximizing their tax savings.

In conclusion, a printable itemized deductions worksheet is a valuable tool for taxpayers who choose to itemize deductions on their tax return. By using this worksheet to carefully document deductible expenses throughout the year, taxpayers can maximize their tax savings and ensure that they are claiming all eligible deductions. Whether you are a seasoned taxpayer or new to itemizing deductions, using a printable itemized deductions worksheet can help you stay organized, reduce stress during tax season, and ultimately save money on your taxes.